Outside of Alaska and Hawaii, oil hasn't been used in meaningful amounts to generate electricity in the United States for decades. Two of the main climate friendly alternatives: nuclear power and hydropower have stalled for independent reasons related to their perceived environmental impact and safety (and inherent limits on how much hydropower can be generated from geography).

Natural gas has increased its market share largely because it makes meeting environmental regulations easier and is cheap to use to produce power once you buy it, but natural gas is more expensive to harvest and more scarce than coal, although its prices have been less subject to geopolitics because it has historically been hard to transport without pipelines. The residual is coal, for the very simple reason that it is cheap because it is abundant and inexpensive to strip mine.

Until a decade or two ago, other renewables made up a negligible share of the electricity generation mix. But, in places like Colorado and New Mexico there has been a dramatic upturn in wind and in solar use. This has both driven and been driven by, falling prices for solar and wind powered electricity generation.

Renewables Have Gotten Much Cheaper In The Last Few Years

Over the last 5 years, the price of new wind power in the US has dropped 58% and the price of new solar power has dropped 78%. . . . Utility-scale solar in the West and Southwest is now at times cheaper than new natural gas plants. . . .

We see the latest proposed PPA price for Xcel’s SPS subsidiary by NextEra (NEE) as in NM as setting a new record low for utility-scale solar. [..] The 25-year contracts for the New Mexico projects have levelized costs of $41.55/MWh and $42.08/MWh. That is 4.155 cents / kwh and 4.21 cents / kwh, respectively. Even after removing the federal solar Investment Tax Credit of 30%, the New Mexico solar deal is priced at 6 cents / kwh. By contrast, new natural gas electricity plants have costs between 6.4 to 9 cents per kwh, according to the EIA. (Note that the same EIA report from April 2014 expects the lowest price solar power purchases in 2019 to be $91 / MWh, or 9.1 cents / kwh before subsidy. Solar prices are below that today.)Via Marginal Revolution.

The New Mexico plant is the latest in a string of ever-cheaper solar deals. SEPA’s 2014 solar market snapshot lists other low-cost solar Power Purchase Agreements. Austin Energy (Texas) signed a PPA for less than $50 per megawatt-hour (MWh) for 150 MW. TVA (Alabama) signed a PPA for $61 per MWh. Salt River Project (Arizona) signed a PPA for roughly $53 per MWh.

Wind prices are also at all-time lows. Here’s Lawrence Berkeley National Laboratory on the declining price of wind power . . . : After topping out at nearly $70/MWh in 2009, the average levelized long-term price from wind power sales agreements signed in 2013 fell to around $25/MWh. After adding in the wind Production Tax Credit, that is still substantially below the price of new coal or natural gas.

Wind and solar compensate for each other’s variability, with solar providing power during the day, and wind primarily at dusk, dawn, and night.

Energy storage is also reaching disruptive prices at utility scale. The Tesla battery is cheap enough to replace natural gas ‘peaker’ plants

In general, renewable energies are seeing technology and mass production drive price reductions that are better than those in the oil and gas industry.

Now, there is a possibility to consider. While these prices are exclusive of subsidies, it could be that investors are engaging in rent seeking behavior and artificially deflating their theoretically unsubsidized prices because they know that with subsidies, this is a sustainable strategy. Compare the car dealership that subsidizes its thin profits on new car sales with big profits on its used car trade in sales.

The Peak Oil Threat Hasn't Gone Away

We've seen a modest slump in oil and gas prices due to the advent of fracking and reduced demand in a slumping global economy, but the long term trend is still the inexorable march towards Peak Oil. The issue is not so much that we will run out of oil and gas reserves, as it is that we will run out of cheap to exploit oil and gas reserves, driving the price of oil and gas ever higher until it reaches a natural limit when extracting oil from recently farmed crops becomes price competitive with oil and gas drilling as a way to produce hydrocarbons.

Coal

Coal is a tougher nut to crack. It is priced where it is not just due to production costs, but because as a product, it can capture the lion's share of the market at whatever price is just a little bit lower than the alternatives. Falling renewable prices are likely to reduce coal prices which have more room for downward movement than natural gas prices, given production costs.

On the other hand, environmentally and in other respects, coal is awful. It makes petroleum look good. Coal produces lots of conventional air pollutants (in addition to toxic and radioactive pollutants that are present in coal in trace amounts) leading to lots of pollution related deaths and permanent harm to the environment including climate change, and it leads to large numbers of production and transportation and generation related accidental injuries and deaths. If coal were forced through regulation and taxation to bear the full share of the externalities generated by its use, it would be significantly more expensive than what utilities now pay for it.

This Price Shift Is Approaching A Tipping Point

This is a huge deal. A shift in the relative prices per kilowatt-hour of electricity generation by different means doesn't just shift the market a little. It is the economic equivalent of a phase change in a substance that crosses a critical pressure-temperature threshold.

Unlike individual consumers of other kinds of energy, electrical utilities are extremely well informed economic actors driven almost purely by economic incentives. A major shift in preferences by a few hundred firms driven by a transition in relative electricity generation prices, particularly in places where electricity demand is expanding due to urban growth, can dramatically and quickly change the mix of fuels used to generate electricity in a matter of a decade or three.

Energy Cost Trendlines

The author of the piece quoted above, based upon historical trends, argues that "Every doubling of cumulative solar production drives module prices down by 20%." I'm deeply skeptical that this is a sustainable trend, but I don't disagree that there are meaningful economies of scale that are yet to be realized in solar and wind power, and that there is room for at least one or two more major scientific breakthroughs that meaningfully reduce cost or otherwise make solar and wind power more attractive. Still, we don't need many rounds 20% reductions to make solar power generation much more economically attractive; one or two would be enough to make a huge difference. So, the trend doesn't really have to be sustainable for very long to make a big difference.

Certainly, we have already come along way. I remember as a child reading Popular Science in the 1970s during the energy crisis, reading stories about how solar power cost three or four times as much per watt as conventional sources (it was actually more like 150 times as expensive according to the historical trend data linked above) and hoping that someday it would reach parity with conventional sources in cost.

It has taken four decades to reach that point, which is far longer than the optimists thought it would at the time. But, we have now just about reached that point and that is a big deal, especially in the West and Southwest of the United States, where the natural conditions are best for solar, and where the most important source of energy demand (air conditioning) closely tracks the availability of solar power to meet that demand.

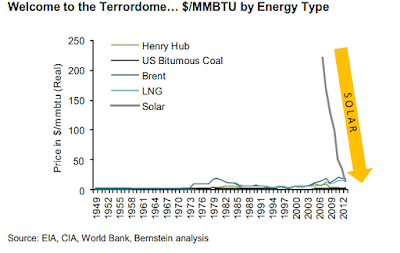

It turns out that almost all of the price reduction has actually come in the last decade:

Graphic from here.

A utopian world with a very large share of renewables in its power grid seems more attainable now than ever.

Storage Cost Limitations For Fickle Solar and Wind Power Generation

However, because both the sun and the wind are fickle, these sources of electricity in the grid are limited to a market share of about 20% in the absence of cost effective power storage (i.e. cheap and efficient batteries or the equivalent), no matter how cheap they are relative to fossil fuels. While progress is still being made in utility scale batteries, storage renewable energy is still a long way from being competitive with on demand burning of fossil fuels, and is improving more slowly than the cost of generating renewable energy itself when the sun and wind conditions are right.

Battery power needs to drop in price about 77% to be competitive with natural gas and coal powered plants, compared to a mere 16% reduction needed for utility scale solar power that is not stored to be competitive in places well suited for it. Wind power, in contrast, when it is available, is already about 40% cheaper than power from natural gas and coal fired plants.

The prospects for progress in battery power are also discouraging because battery power is a considerably more mature technology than large scale solar and wind powered electricity generation. So, one would expect slower progress in this area than we have seen in the last decade in solar and wind power.

Footnote: Transportation Energy Issues

Electricity off the grid is already roughly 80% less expensive source of energy than gasoline or diesel or ethanol for motor vehicles (comparing the cost of powering an mass produced plug in electric vehicle like a Chevy Volt or Nissan Leaf or Tesla S per mile to the cost of powering a comparable vehicle with a gasoline or diesel fueled engine).

The trouble is that it isn't easy to get the electricity to the vehicles. You either need a fixed guide way transit system, either from an electrified overhead wire, or a powered "third rail", or you need cheap, high energy density, compact, and quickly rechargeable batteries or some technological equivalent to that, to store the electricity used to power the vehicle.

Cost and energy density are really the only remaining barriers to widespread use of electric cars. I purchased a car this month, but didn't purchase an electric one, even though they are widely available and tax credits made one price competitive, because it didn't have sufficient battery range and I anticipate being a one car family for most of the time that I own one.

The Tesla S, which is a mass produced available for sale electric car with a range competitive with gasoline and diesel vehicles (200 miles or so), without compromising meaningfully on what the car can do or carry, illustrates that at this point the technological barrier to widespread electric cars is ultimately far more a matter of cost than energy density. If we could make electric car batteries for 10%-20% of their current price, electric cars would be dominant at current electricity and oil prices, even without tax subsidies.

Another potentially "natural" limit to the mass production of battery powered vehicles is that these batteries currently require large volumes of rare earth metals which are sufficient to meet currently low level production demands, but would become a powerful limiting factor (and environmental concern) if electric car production volumes dramatically increased. Of course, if the "better battery" was cheaper and used fewer rare earth metals (indeed, eliminating rare earth metals from batteries is a good strategy for making them cheaper), then this problem could be averted.

A mass shift to electric cars from oil byproduct fueled cars, of course, would dramatically increase the demand for electricity, which in turn, would dramatically favor whatever means of electricity generation was cheapest at the time. (Actually, this seemingly obvious fact isn't nearly as certain as it would seem, because oil refineries use a lot of electricity to turn oil into gasoline and diesel power.)

To hit the environmentalists utopian sweet spot, we'd like the cheaper battery for electric cars to be invented shortly after renewables secure a definitive edge in the market place for new utility generated electricity. This "jackpot" result now seems to be within the realm of the possible and even the plausible, although it is hardly a certain, or even more likely than not possibility.

Second Footnote: Solar Energy For Purposes Other Than Electricity Generation

Photovoltaic application (i.e. making electricity with solar power) is not really the most efficient way to turn the sun's rays into useful energy. This requires turning high entropy heat into low entropy electricity, and overcoming the Second Law of Thermodynamics is expensive in terms of power generation efficiency.

Solar energy, used properly, can be much more efficient in reducing home heating and water heating demand, a measure sometimes described as energy conservation, rather than energy generation, because it reduces the consumption of conventional energy sources like electricity, natural gas and heating oil for someone using it.

Third Footnote: The Impact of Synthetic Oil and Gas From Coal

Coal's undesirable properties have led to a situation where it is used almost entirely as the lowest cost source of electricity generation. Only a tiny share of all coal produced is used for anything else.

If the legal framework forced this use of coal to bear all of its externalities, the cost of coal fired electricity would be much greater.

There is another way of using coal that is less noxious, although it really hasn't been determined how much less noxious. One can synthesize oil and methane (or other hydrocarbon gases like those found in natural gas) from coal, and it appears to be easier to contain pollutants from the coal in this synthesis process than it is to do so when simply burning coal at a utility power plant (even with advanced utility technology like smokestack scrubbers).

At some point, the cost of mining coal and converting it to synthetic oil and gas may be competitive with the cost of direct oil and gas production from natural reserves. Indeed, in the last decade, we flirted with oil price points where synthesizing oil from coal was price competitive (it requires an oil price in modestly in excess of $100 a barrel at current coal prices).

When oil prices eventually reach a sustained floor of significantly more than $100 a barrel (and even before then), synthesizing oil from coal will start to look like an attractive alternative. If oil prices increased as a result of taxes designed to include their externalities, this could happen sooner rather than later.

I don't know the price point at which synthesizing natural gas from coal becomes competitive with direct natural gas production, but my understanding is that we have flirted with that price point as well during periods of time when natural gas prices were near their modern peaks.

Thus, ironically, increasing the cost of natural gas could make much cleaner uses of coal economically viable. Synthetic gas production from coal would also effectively place a cap on natural gas prices, even when direct natural gas production costs exceeded that price.

Both these points imply that there are natural limits to the extent that Peak Oil, and rising natural gas prices can lead to an increase in renewable energy production, as opposed to a switch from "natural" mineral sources of oil and gas to synthetic production of oil and gas from coal. Some additional price reductions in the costs of renewable energy generated electricity, that makes it securely price competitive with synthetic oil and gas products from coal (even when this new technology falls in cost with economies of scale), are also necessary for a transition to take place. But, current trends don't have to continue very much longer for this to happen.

No comments:

Post a Comment